Real Estate Investment Trusts (REITs) er fonde, der investerer i ejendomme. Typisk kan fondene være med til at være beskytte mod inflation, fordi ejendomspriserne typisk også stiger med inflationen, bl.a. fordi folk begynder at købe fast ejendom. REIT skal også udbetale udbytte til investorerne.

Som altid kan man blive klog af at lytte til Ben Felix:

Hvorfor REIT

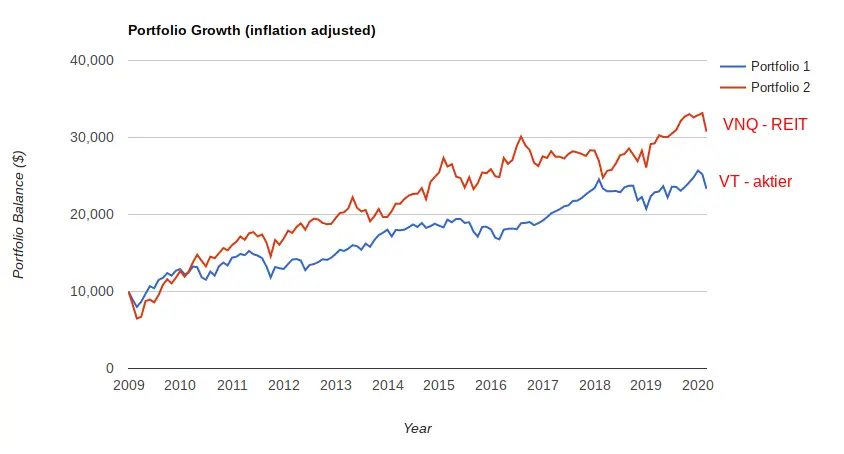

REIT er et værktøj til at komme ind i ejendomsmarkedet uden selv at behøve at eje ejendomme. REIT bevæger sig typisk også lidt anderledes end aktiemarkedet.

Obvious Investor har REIT som en del af sit Growth Portfolio og har skrevet en fin artikel om hvad REIT er?

Er REITs en god beskyttelse mod inflation?

J. L. Collins mener dog nu ikke længere, at REIT fungerer særlig godt som et værn mod inflation.

“Stocks are, over time, a fine inflation hedge. People forget that stocks are not just pieces of paper. Stocks are pieces of ownership in operating businesses. Sales, inventory, plants, equipment, brands et al. All of which rise in value with inflation.”

— Paul, som svar til J. L. Collins

The problem is that REITs are made up primarily of companies that hold office buildings, apartment buildings and the like. Once you put a building on a piece of land it effectively becomes a business with the same potential and shortcomings of other businesses. That’s fine in times of normal to high inflation. In times of hyper-inflation we’re asking too much of it.

I guess part of my reluctance to buy into REITs is from looking at the fundamentals. Land itself is not a productive asset. Therefore, unlike stocks which are based on companies, it cannot increase in productivity. Any capital gains on real estate is due to some other factor.

Hvordan REIT?

Du kan naturligvis købe de enkelte REITs, men jeg hælder meget mere til at købe ETF’er som har et bredt udsnit af REITs, så jeg har en højere diversificering i min portefølje.

Jeg har fundet følgende interessante muligheder.

| Tick | Værdipapir | ÅOP | Morningstar rating | Bæredygtighed | Forvaltning |

|---|---|---|---|---|---|

| SPYJ | SPDR® Dow Jones Global Real Estate UCITS ETF (EUR) | 0,40% | ★★★☆☆ | ⚫⚫⚫⚫⚪ | Passiv |

| H4ZL | HSBC FTSE EPRA NAREIT Developed UCITS ETF (EUR) | 0,40% | ★★★☆☆ | ⚫⚫⚫⚪⚪ | Passiv |

| TRET | VanEck Vectors™ Global Real Estate UCITS ETF (EUR) | 0,25% | ★★★☆☆ | ⚫⚫⚫⚫⚪ | Passiv |

| D5BK | Xtrackers FTSE Developed Europe Real Estate UCITS ETF 1C (EUR) | 0,33% | ★★★☆☆ | ⚫⚫⚫⚫⚪ | Passiv |

| XREA | Xtrackers FTSE Developed Europe ex UK Real Estate UCITS ETF 1C (EUR) | 0,33% | ★★★★☆ | ⚫⚫⚫⚫⚪ | Passiv |

| IQQP | iShares European Property Yield UCITS ETF EUR (Dist) (EUR) | 0,40% | ★★★★☆ | ⚫⚫⚫⚫⚪ | Passiv |

Hvad er alternativet?

William Bernstein mener, at en internationalt diversificeret er lige så god som at holde REIT.

The cheapest solution is to hold an internationally diversified stock portfolio, so that rampant inflation in the U.S. can be offset by more stable returns from foreign stocks.

— William Bernstein fra Forbes

Money - Master the Game - 7 Simple Steps to Financial Freedom

Tony Robbins, the multimillion-copy bestselling author of Awaken the Giant Within and Unlimited Power has created a 7-step blueprint for securing financial freedom. Based on extensive research and one-on-one interviews with more than 50 of the most legendary financial experts in the world - from Carl Icahn, to Warren Buffett, to Jack Bogle and Steve Forbes.

The Simple Path to Wealth

This book grew out of a series of letters to my daughter concerning various things-mostly about money and investing-she was not yet quite ready to hear. Since money is the single most powerful tool we have for navigating this complex world we’ve created, understanding it is critical.

Four Pillars of Investing: Lessons for Building a Winning Portfolio

With relatively little effort, you can design and assemble an investment portfolio that, because of its wide diversification and minimal expenses, will prove superior to the most professionally managed accounts. Great intelligence and good luck are not required. William Bernstein s commonsense approach to portfolio construction has served investors well during the past turbulent decade and it s what made The Four Pillars of Investing an instant classic when it was first published nearly a decade ago.

Hvis du kan lide sitet, så klik dig videre fra de forskellige links eller støt sitet ved at købe mig en kop kaffe eller gennem Flattr.

Disclaimer: iFire.dk modtager kommission gennem affiliate links og omtale af udvalgte finansielle produkter og services. Disse links er markeret med (*). Jeg anstrenger mig for at være neutral og objektiv, og jeg har selv investeret og brugt alle værktøjer på sitet.

Jeg fralægger mig ethvert ansvar for aktualitet, nøjagtighed, og gyldighed af oplysningerne på dette website. Jeg kan ikke holdes til ansvar for evt. tab på baggrund af information.

Skriv en kommentar